Staged Homes Sell 73% Faster

Staged homes sell 73% faster. That’s not a coincidence. If you want to sell quickly, let’s chat about whether staging makes sense for you.

Staged homes sell 73% faster. That’s not a coincidence. If you want to sell quickly, let’s chat about whether staging makes sense for you.

If you’ve seen headlines or social posts calling for a housing crash, it’s easy to wonder if home values are about to take a hit. But here’s the simple truth.

The data doesn’t point to a crash. It points to slow, continued growth.

And sure, it’s going to vary by local area. Some markets will see prices rise more than others. And some may even see small, short-term declines. But the big picture is: home prices are expected to rise nationally, not fall, over the next 5 years.

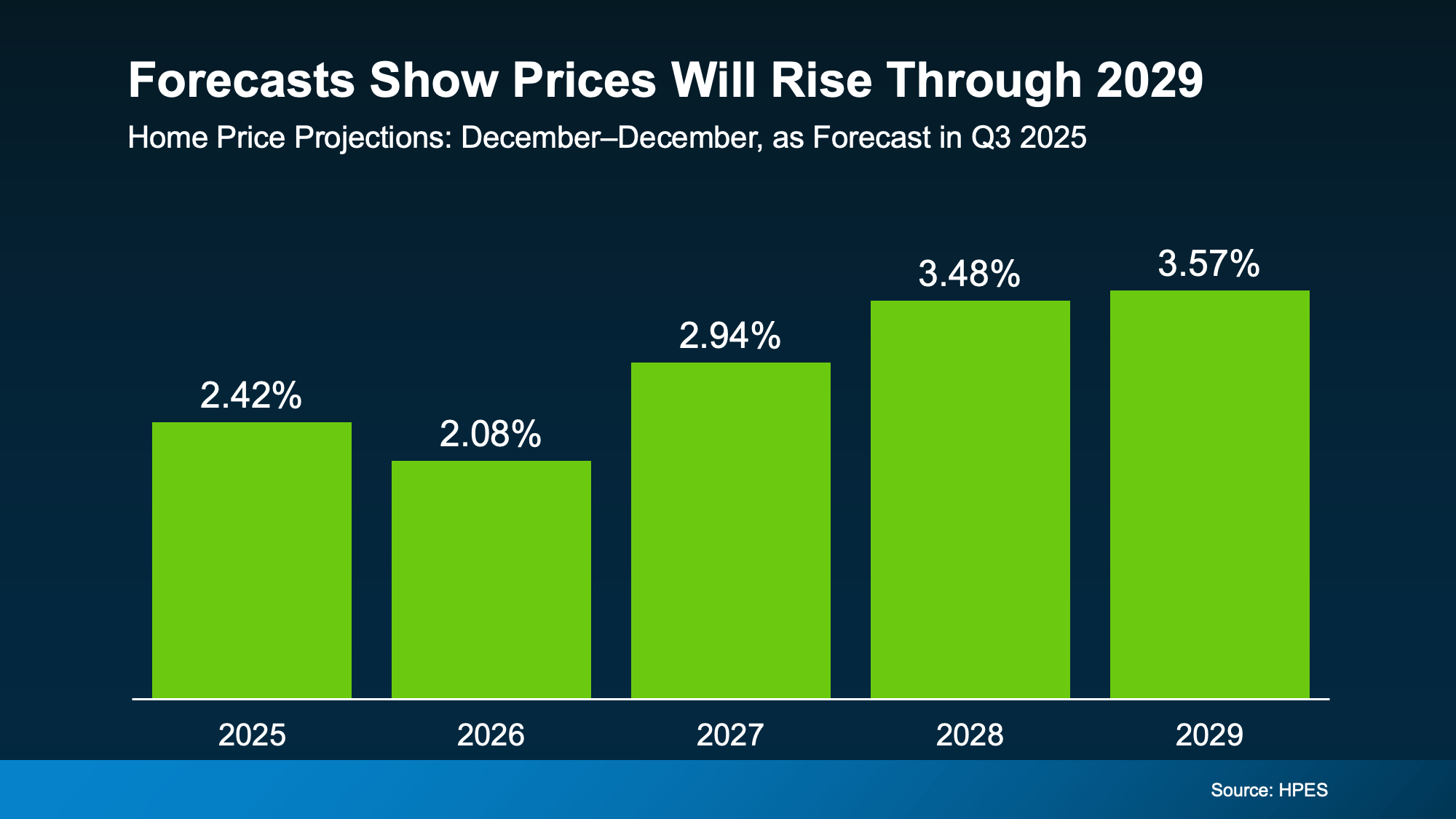

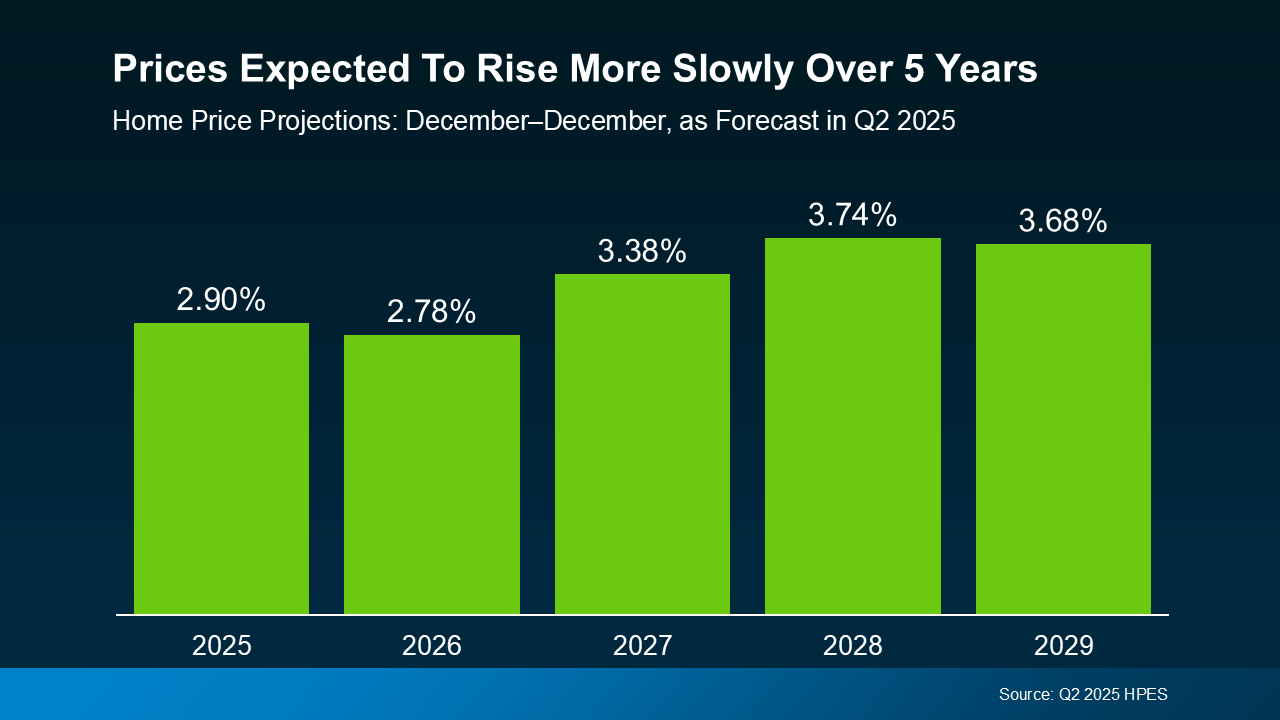

In the Home Price Expectations Survey (HPES) from Fannie Mae, each quarter over 100 leading housing market experts weigh in on where they project home prices will go from here. And in the report that was just released, the experts agree prices are projected to climb nationally through at least 2029 (see graph below):

Here’s how to read this visual. Each bar in that graph shows an increase, not a loss. It’s just that the anticipated pace of that appreciation varies year-to-year.

Here’s how to read this visual. Each bar in that graph shows an increase, not a loss. It’s just that the anticipated pace of that appreciation varies year-to-year.

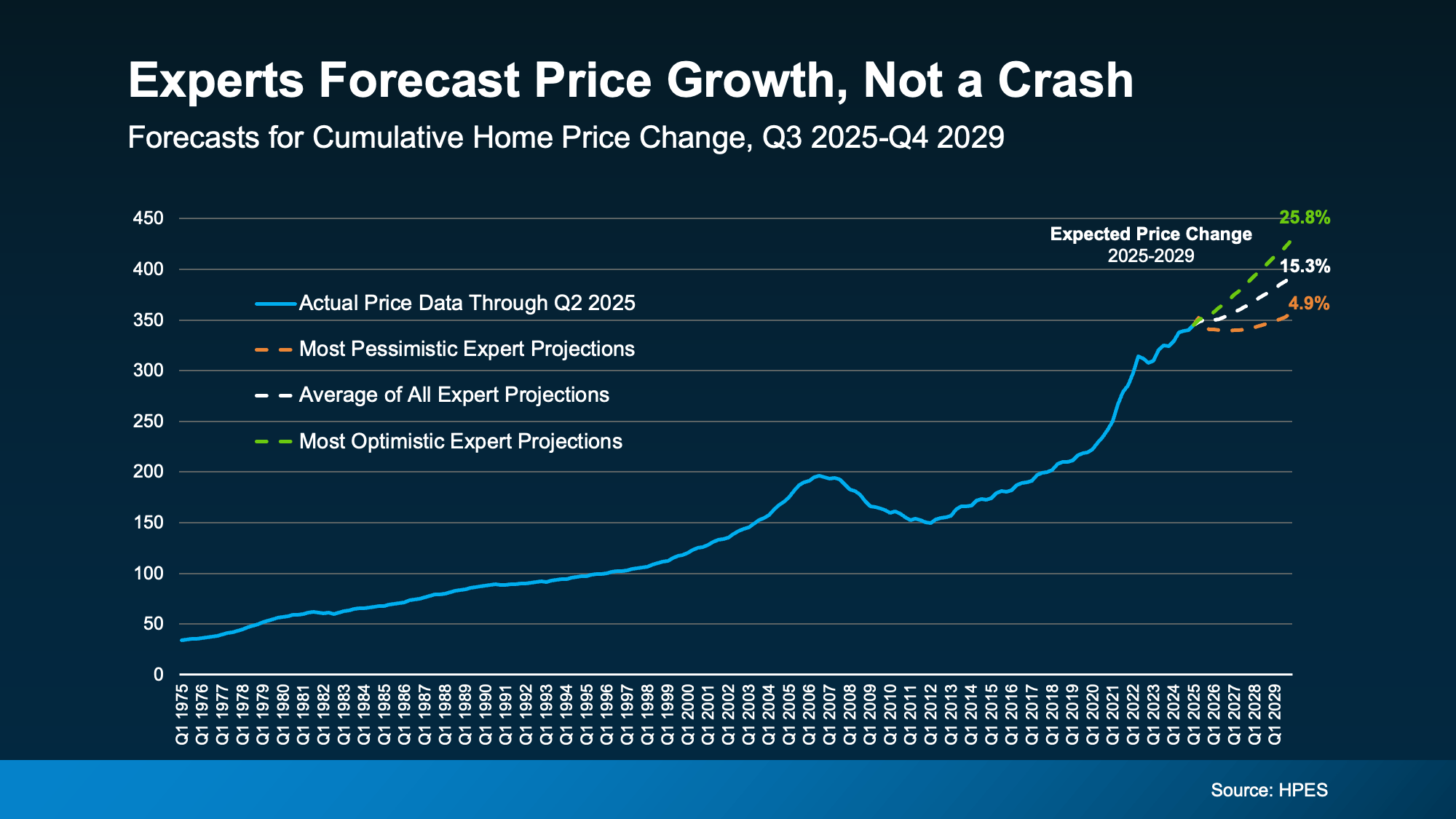

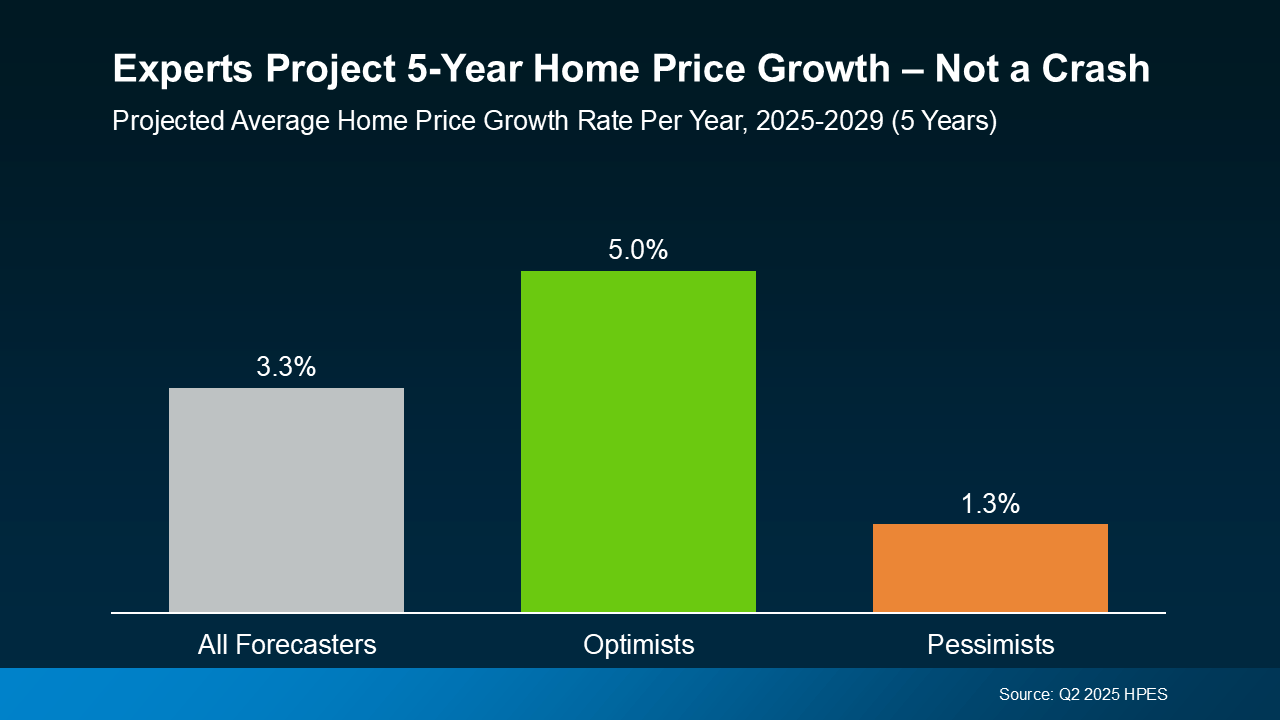

And to further drive this home, let’s look at another view of where prices are and where they’re expected to go. In this version, the expert forecasts are broken into 3 categories: the overall average, the most optimistic projections, and the most pessimistic projections (see chart below):

Notice how even the most pessimistic forecasters say we’ll see prices rise by almost 5% over the next few years.

Notice how even the most pessimistic forecasters say we’ll see prices rise by almost 5% over the next few years.

What sticks out the most? None of these groups who study the market are forecasting a crash, or even a decline, over the next 5 years.

Now, focus back on the first graph. The projections call for 2-3.5% price increases in each of the next five years. For context, the average rate of appreciation for the last 25 years was closer to 4-5% annually.

So, while that’s slightly below the historical average, it’s much more sustainable and typical than where the market was in 2020, 2021, and 2022.

Back then, prices rose too much, too fast based on record-low supply and record-high demand. Some places even saw prices climb by 15-20%.

So, while it may feel like prices are stalling compared to those pandemic-era surges, what’s really happening is that the market is finally finding balance again.

A lot of the chatter about home prices today is based on that rapid rise and the old saying that what goes up, must come down. But historically, that’s not really true. Home prices almost always rise.

And the main reason we’re not heading for a repeat of 2008 is simple: supply and demand.

Even though affordability challenges have made it harder for some people to buy over the past few years, there still aren’t enough homes for everyone who wants one. And that ongoing shortage is keeping upward pressure on prices nationally.

That’s why experts across the board can confidently agree: we’re not headed for a price collapse, but for steady, long-term appreciation.

And just in case it’s the economy that’s got you worried, remember this. Over the past 50 years, there have been plenty of economic events that have impacted the market. And one thing that’s consistently been true throughout time is the housing market always recovers. And we’re coming through that turn right now and going into a recovery.

If you’ve been waiting to buy or sell because you’re worried about a crash, it’s time to look at the data – not the headlines.

The question isn’t if home prices will rise, it’s by how much.

Let’s connect so you know what’s happening in our local market and what these forecasts mean for your next move.

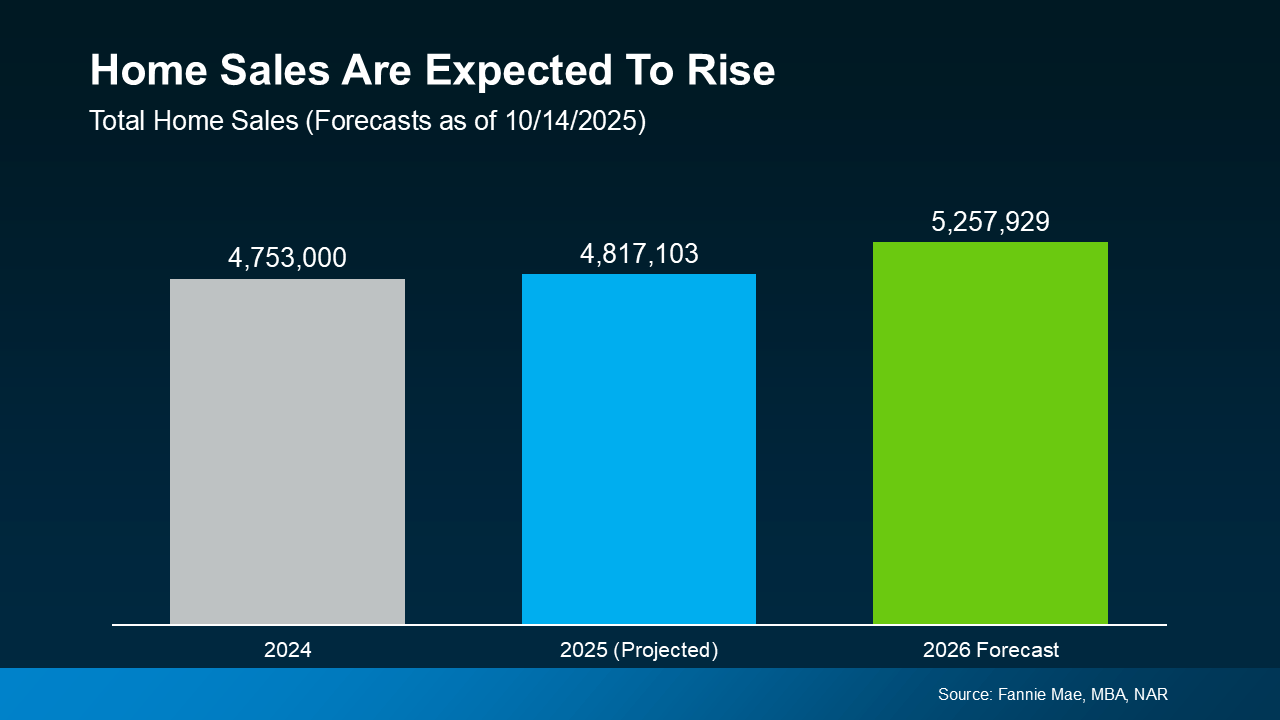

After a couple of years where the housing market felt stuck in neutral, 2026 may be the year things shift back into gear. Expert forecasts show more people are expected to move – and that could open the door for you to do the same.

With all of the affordability challenges at play over the past few years, many would-be movers pressed pause. But that pause button isn’t going to last forever. There are always people who need to move. And experts think more of them will start to act in 2026 (see graph below):

What’s behind the change? Two key factors: mortgage rates and home prices. Let’s dive into the latest expert forecasts for both, so you can see why more people are expected to move next year.

What’s behind the change? Two key factors: mortgage rates and home prices. Let’s dive into the latest expert forecasts for both, so you can see why more people are expected to move next year.

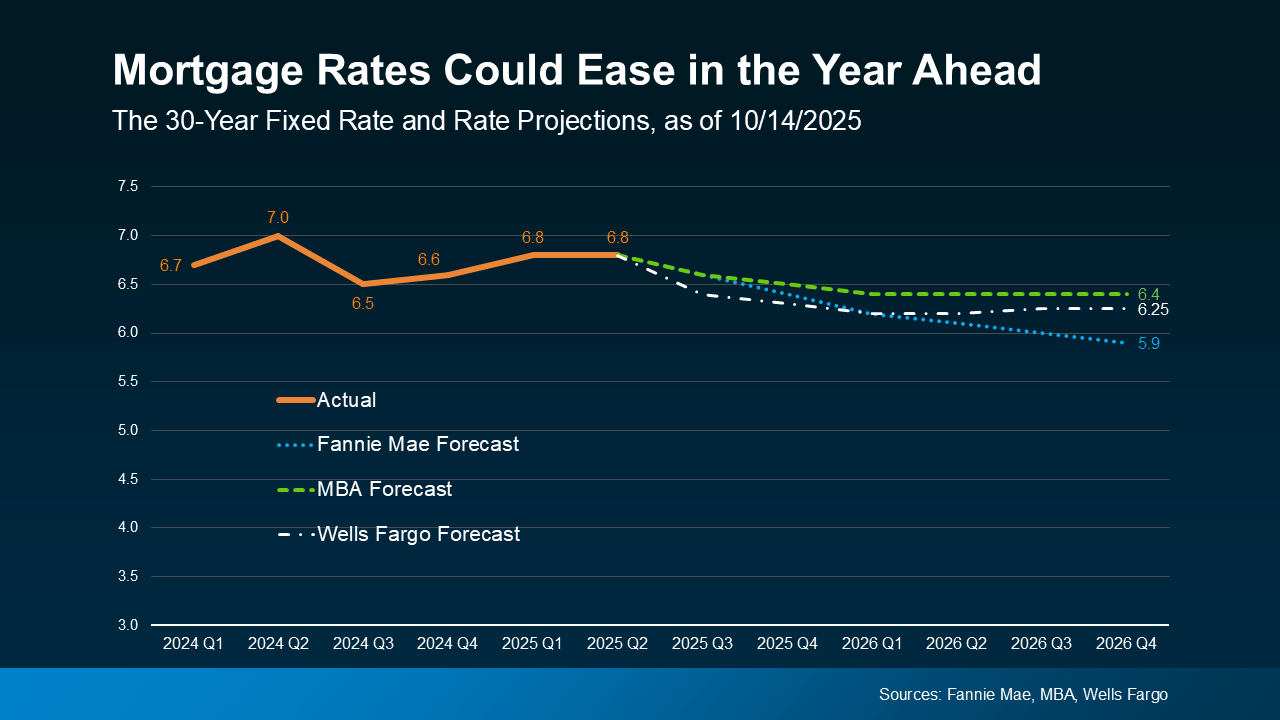

The #1 thing just about every buyer has been looking for is lower mortgage rates. And after peaking near 7% earlier this year, rates have started to ease.

The latest forecasts show that could continue throughout 2026, but it won’t be a straight line down (see graph below):

There’s a saying: when rates go up, they take the escalator. But when they come down, they take the stairs. And that’s an important thing to remember. It’ll be a slow and bumpy process.

There’s a saying: when rates go up, they take the escalator. But when they come down, they take the stairs. And that’s an important thing to remember. It’ll be a slow and bumpy process.

Expect modest improvement in mortgage rates over the next year but be ready for some volatility. There will be volatility along the way as new economic data comes out. Just don’t let it distract you from the bigger picture: the overall trend will be a slight decline. Forecasts say we could hit the low 6s, or maybe even the high 5s.

And remember, there doesn’t have to be a big drop for you to feel a change. Even a smaller dip helps your bottom line.

If you compare where rates are now to when they were at 7% earlier this year, you’re already saving hundreds on your future mortgage payment. And that’s a really good thing. It’s enough to make a real difference in affordability for some buyers.

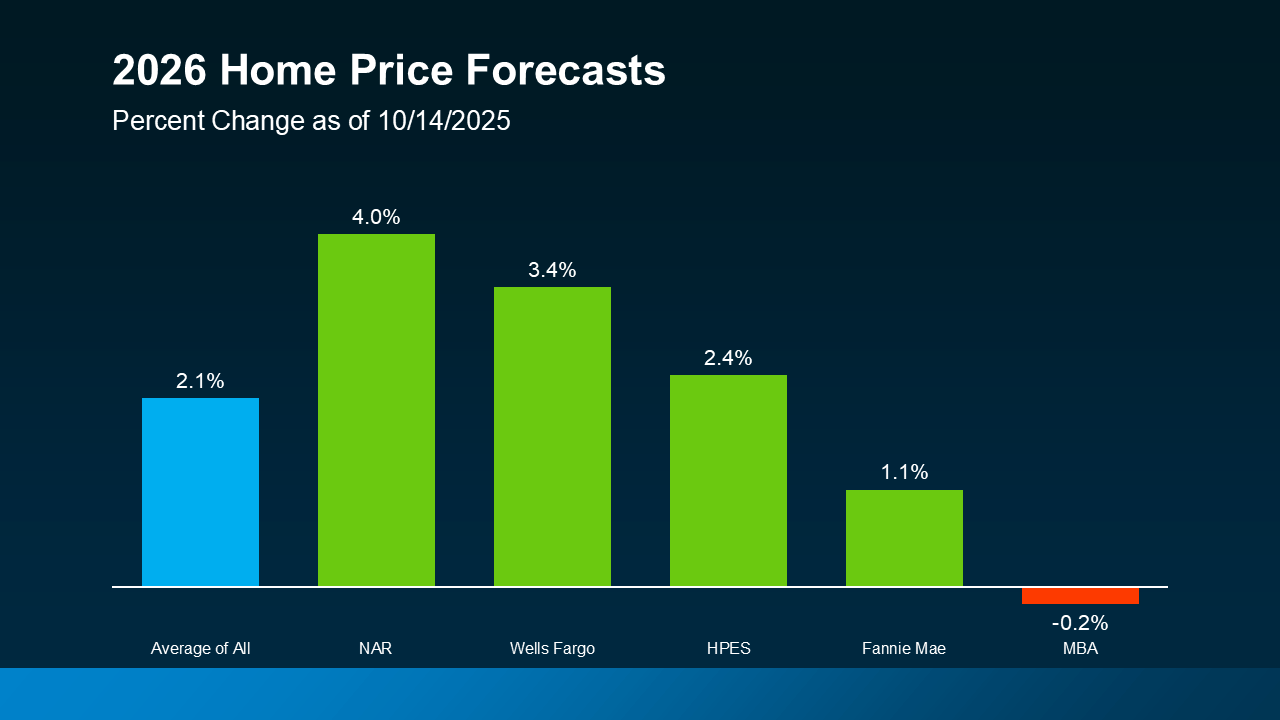

What about prices? On a national scale, forecasts say they’re still going to rise, just not by a lot. With rates down from their peak earlier this year, more buyers will re-enter the market. And that increased demand will keep some upward pressure on prices nationally – and prevent prices from tumbling down.

So, even though some markets are already seeing slight price declines, you can rest easy that a big crash just isn’t in the cards. Thanks to how much prices rose over the last 5 years, even the markets seeing declines right now are still up compared to just a few years ago.

Of course, price trends will depend on where you are and what’s happening in your local market. Inventory is a big driver in why some places are going to see varying levels of appreciation going forward. But experts agree we’ll see prices grow at the national level (see graph below):

This is yet another good sign for buyers and overall affordability. While prices will still go up nationally, it’ll be at a much more sustainable pace. And that predictability makes it easier to plan your budget. It also gives you peace of mind that prices won’t suddenly skyrocket overnight.

This is yet another good sign for buyers and overall affordability. While prices will still go up nationally, it’ll be at a much more sustainable pace. And that predictability makes it easier to plan your budget. It also gives you peace of mind that prices won’t suddenly skyrocket overnight.

After a quieter couple of years, 2026 is expected to bring more movement – and more opportunity. With sales projected to rise, mortgage rates trending lower, and price growth slowing down, the stage is set for a healthier, more active market.

So, the big question: will you be one of the movers making 2026 your year?

Let’s connect if you want to get ready.

1 in 5 sellers are cutting prices right now. That means you’ve got room to maybe score a better deal. Want to know which negotiation strategies are working for buyers in our area? Let’s chat.

These days, you’re going to want to get your price right when you get ready to sell your house. Honestly, it’s more important than ever. Why? While you may want to list high just to see what happens, that’s a plan that can easily backfire, and it’s going to cost you in today’s market.

And the risk isn’t just missing out on offers, it’s missing out on the move you needed to make in the first place.

Many homeowners remember what their neighbor’s house sold for a few years ago, and they want to chase that same sky-high number. The problem is, that was a different market.

Today, there are more homes for sale. Buyers have more options to choose from. They don’t have to get into bidding wars where they offer way over asking just to compete. Now they can come in at, or even below, list price. And if you’re not open to that, they’ll move on. Lisa Sturtevant, Chief Economist at Bright MLS, explains:

“Buyers will have more leverage in many, but not all, markets. Sellers will need to adjust price expectations to reflect the transitioning market.”

But here’s the good news. You still have one big advantage as a seller. According to the Federal Housing Finance Agency (FHFA), home values went up by a staggering 54% over the last 5 years. So, even if you compromise just a little bit on your sale price today, odds are you’ll still come out way ahead.

The challenge? Most sellers aren’t thinking about it that way. They’re stuck on what a neighbor got months or years ago – and that’s a costly mistake.

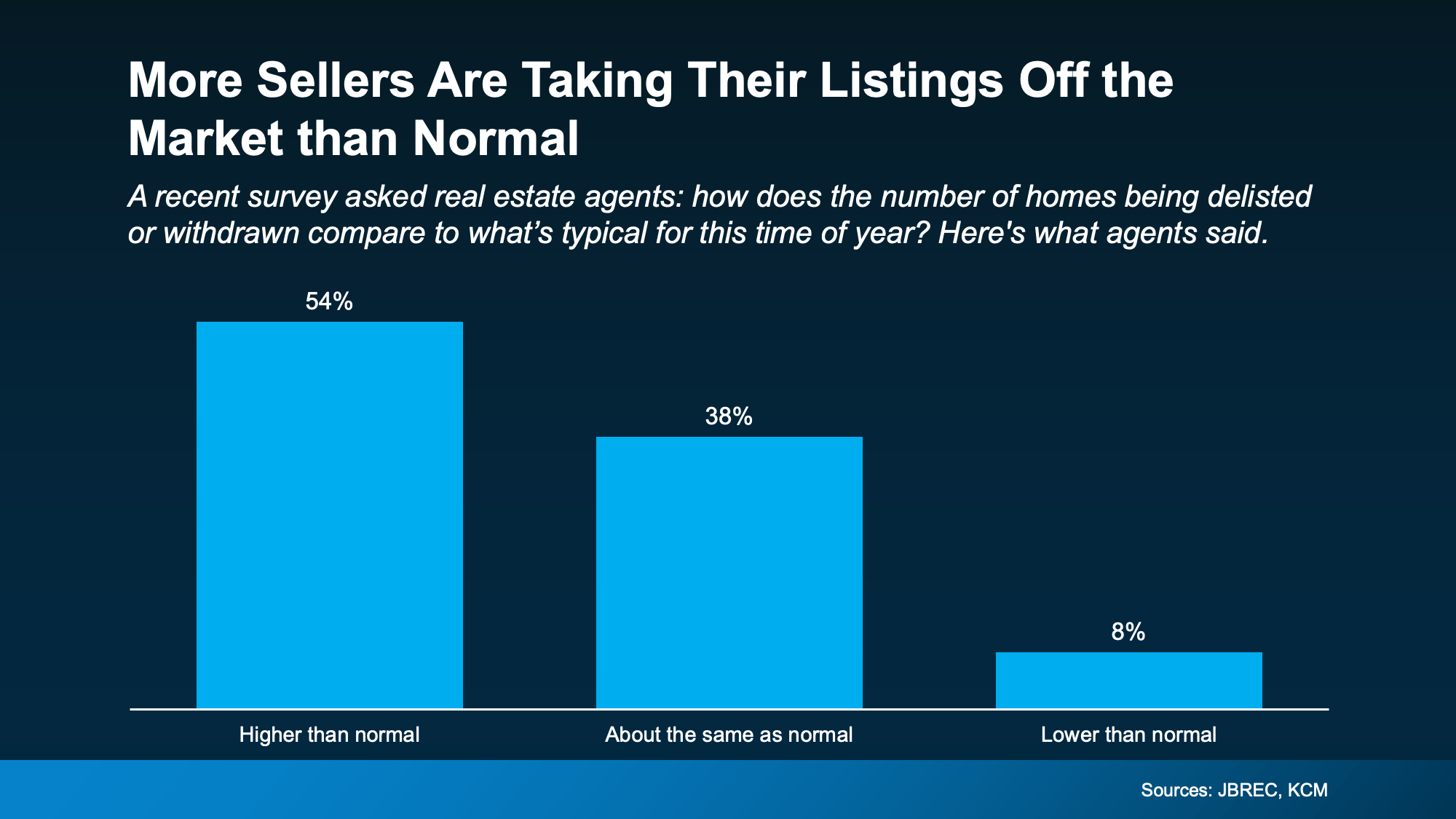

Here’s what happens. A seller lists too high. Buyers stay away. No offers come in. The house sits. And suddenly, that seller is facing a tough decision. Do they cut the price? Stick it out? Or give up altogether?

Unfortunately, a late price cut may not be enough. Buyers often see that as a red flag that something’s wrong with the house. That’s why some sellers are opting to just pull their listing off the market entirely.

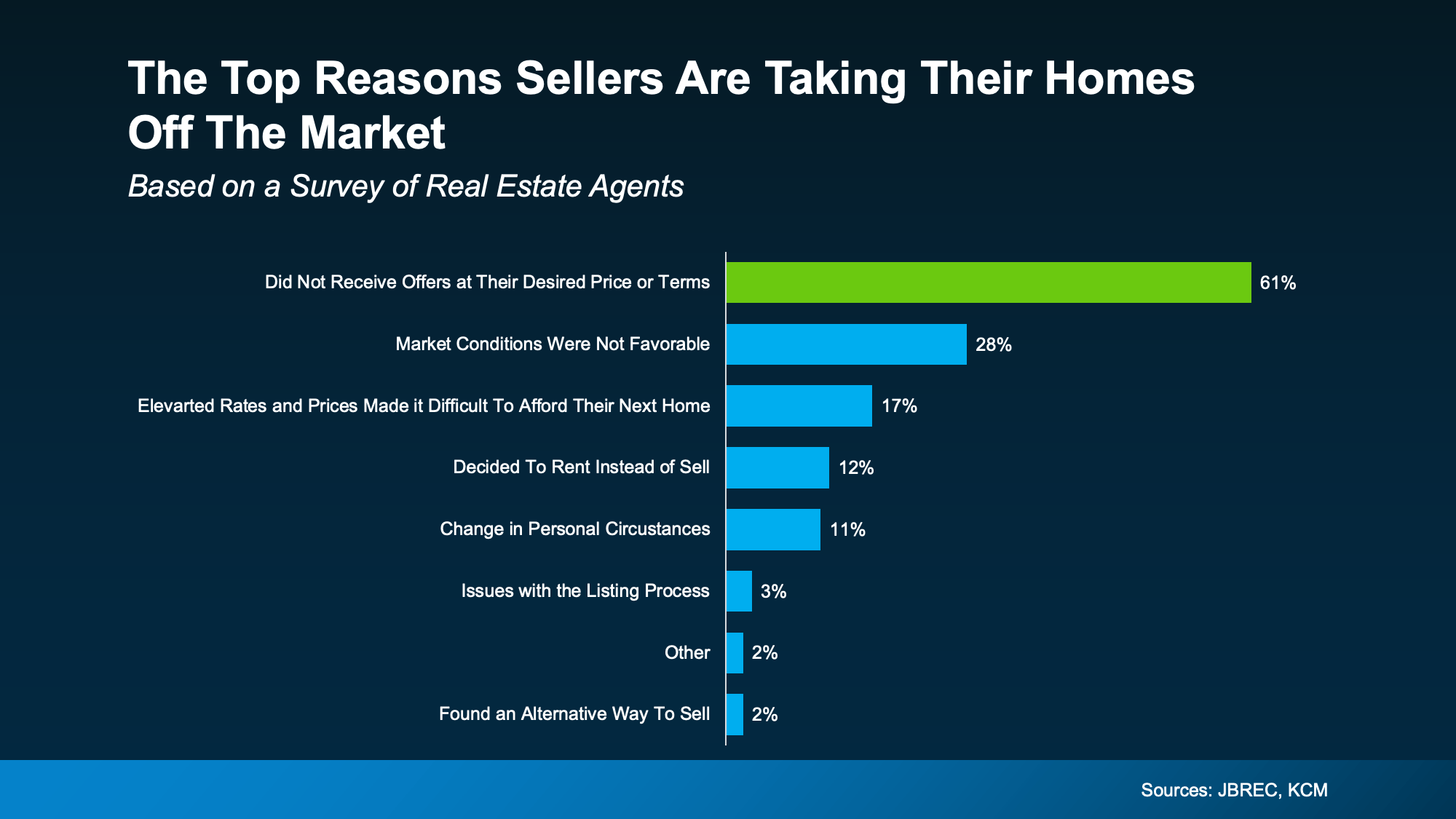

In a recent survey from John Burns Research and Consulting (JBREC) and Keeping Current Matters (KCM) over half of agents (54%) say there are more homes being taken off the market than usual.

And the top reasons for that? According to the agents, homeowners didn’t get any offers they felt were fair. The survey from JBREC and KCM explains it like this:

And the top reasons for that? According to the agents, homeowners didn’t get any offers they felt were fair. The survey from JBREC and KCM explains it like this:

“Sellers holding onto high price expectations is the leading reason they are delisting their homes.”

BrightMLS data backs this up:

BrightMLS data backs this up:

“. . . sellers are delisting after having their home on the market and finding they are not getting the price they hoped for.”

It’s more proof pricing too high does more than turn buyers away, it puts your whole move at risk. Because if no one looks at your home or makes an offer, how are you going to sell it?

If you’re selling to relocate for a job, need more space for your growing family, or have to be closer to your relatives as they age, you can’t afford to get stuck. You need a pricing strategy that helps you move forward – and that starts with the right agent.

The sellers who are winning right now are the ones working with experienced local agents who know the current market and aren’t afraid to have honest conversations about price.

And it’s paying off. In the right price range and condition, homes are still selling fast, sometimes even with multiple offers.

Pricing your house for today’s market isn’t just about getting it sold. It’s about making sure your move doesn’t stall before it starts.

Let’s talk through what buyers are really paying right now in our local area, and how to price your home to match.

If you’ve been following real estate news lately, you’ve probably seen headlines saying home prices are flat. And at first glance, that sounds simple enough. But here’s the thing. The reality isn’t quite that straightforward.

In most places, prices aren’t flat at all.

While we’ve definitely seen prices moderate from the rapid and unsustainable climb in 2020-2022, how much they’ve changed is going to be different everywhere.

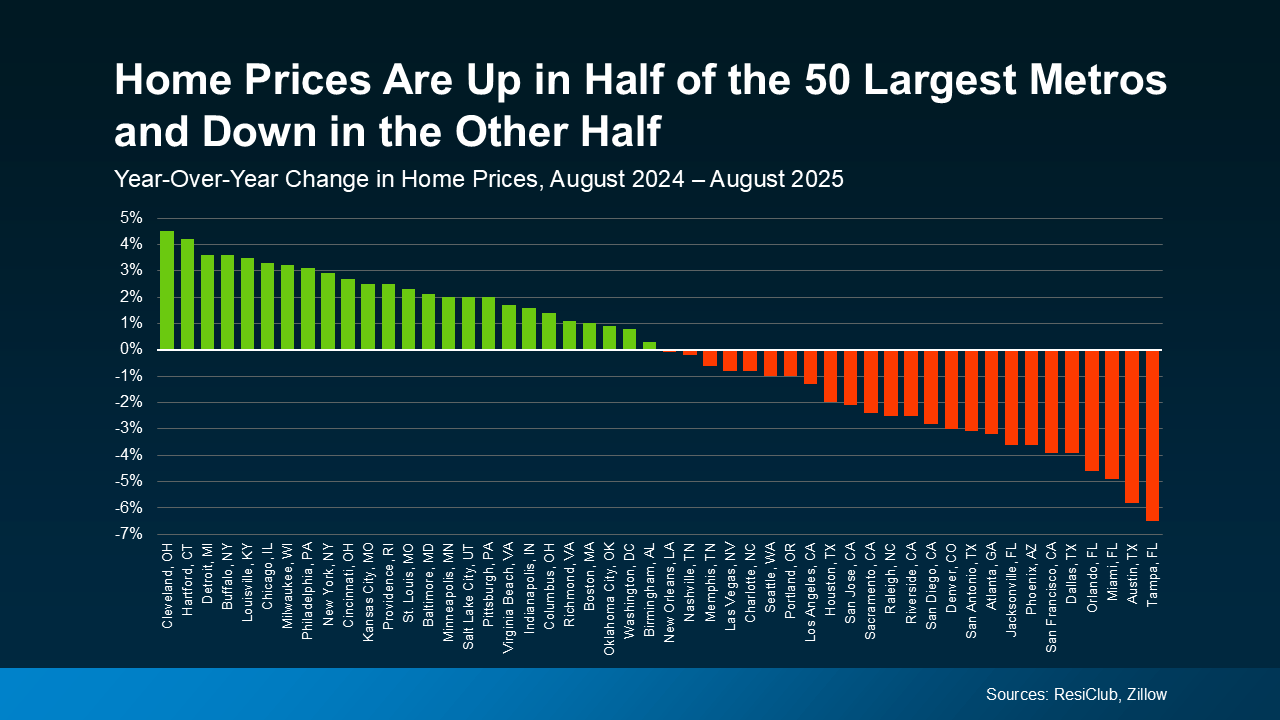

If you look at data from ResiClub and Zillow for the 50 largest metros, this becomes very clear. The real story is split right down the middle. Half of the metros are still seeing prices inch higher. The other half? Prices are coming down slightly (see graph below).

The big takeaway here is “flat” doesn’t mean prices are holding steady everywhere. What the numbers actually show is how much price trends are going to vary depending on where you are.

The big takeaway here is “flat” doesn’t mean prices are holding steady everywhere. What the numbers actually show is how much price trends are going to vary depending on where you are.

One factor that’s driving the divide? Inventory. The Joint Center for Housing Studies (JCHS) of Harvard University explains:

“ . . . price trends are beginning to diverge in markets across the country. Prices are declining in a growing number of markets where inventories have soared while they continue to climb in markets where for-sale inventories remain tight.”

When you average those very different trends together, you get a number that looks like it’s flat. But it doesn’t give you the real story and it’s not what most markets are feeling today. You deserve more than that.

And just in case you’re really focusing on the declines, remember those are primarily places where prices rose too much, too fast just a few years ago. Prices went up roughly 50% nationally over the past 5 years, and even more than that in some of the markets that are experiencing a bigger correction today. So, a modest drop in some local pockets still puts most of those homeowners ahead when it comes to the overall value of their home. And based on the fundamentals of today’s housing market, experts are not projecting a national decline going forward.

So, what’s actually important for you to know?

You need to know what’s happening in your area because that’s going to influence everything from how quickly you need to make an offer to how much negotiating power you’ll have once you do.

The bottom line? Knowing your local trend puts you in the driver’s seat.

You’ll want to be aware of local trends, so you’ll know how to price your house and how much you can expect to negotiate.

The big action item for homeowners? Sellers need to have an agent’s local perspective if they want to avoid making the wrong call on pricing – and homes that are priced right are definitely selling.

The national averages can point to broad trends, and that’s helpful context. But sometimes you’re going to need a local point of view because what’s happening in your zip code could look different. As Anthony Smith, Senior Economist at Realtor.com, article puts it:

“While national prices continued to climb, local market conditions have become increasingly fragmented…This regional divide is expected to continue influencing price dynamics and sales activity as the fall season gets underway.”

That’s why the smartest move, whether you’re buying or selling, is to lean on a local agent who’s an expert on your market.

They’ll have the data and the experience to tell you whether prices in your area are holding steady, moving up, or softening a bit – and how that could impact your move.

Headlines calling home prices flat may be grabbing attention, but they’re not giving you the full picture.

Has anyone taken the time to walk you through what we’re seeing right here, right now?

If you want the real story about what prices are doing in our market, let’s connect.

You want mortgage rates to fall – and they’ve started to. But is it going to last? And how low will they go?

Experts say there’s room for rates to come down even more over the next year. And one of the leading indicators to watch is the 10-year treasury yield. Here’s why.

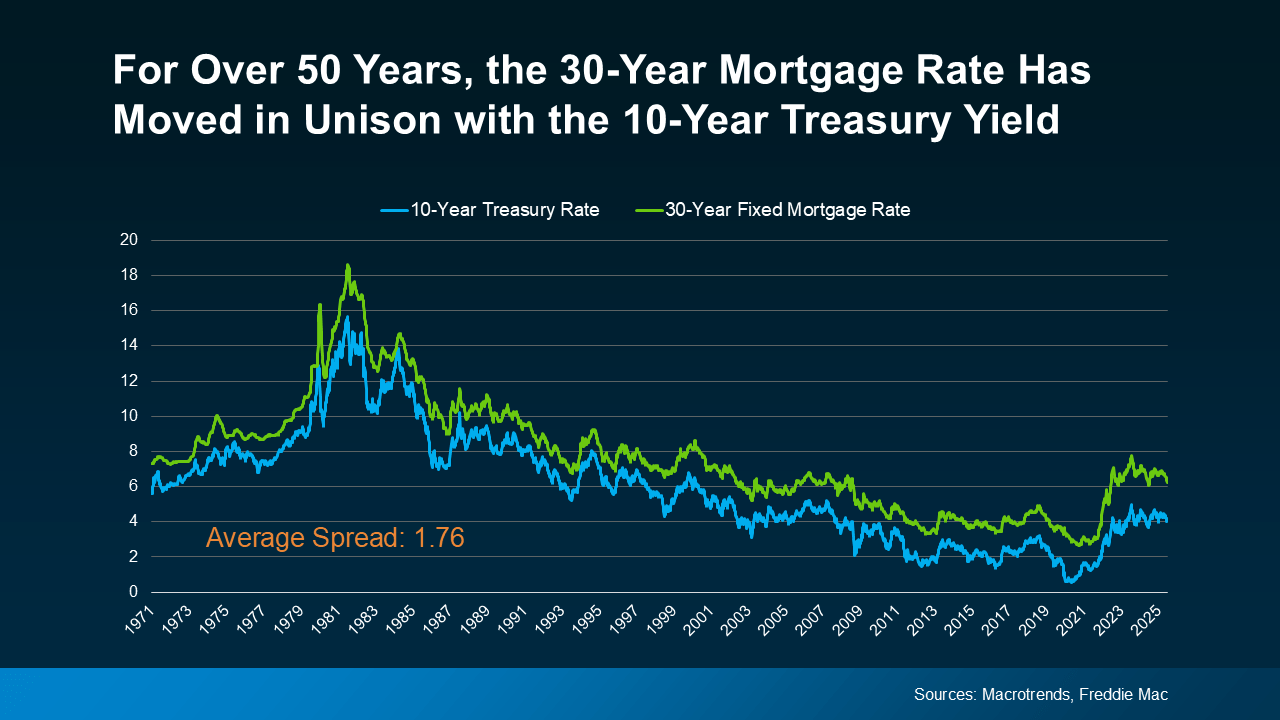

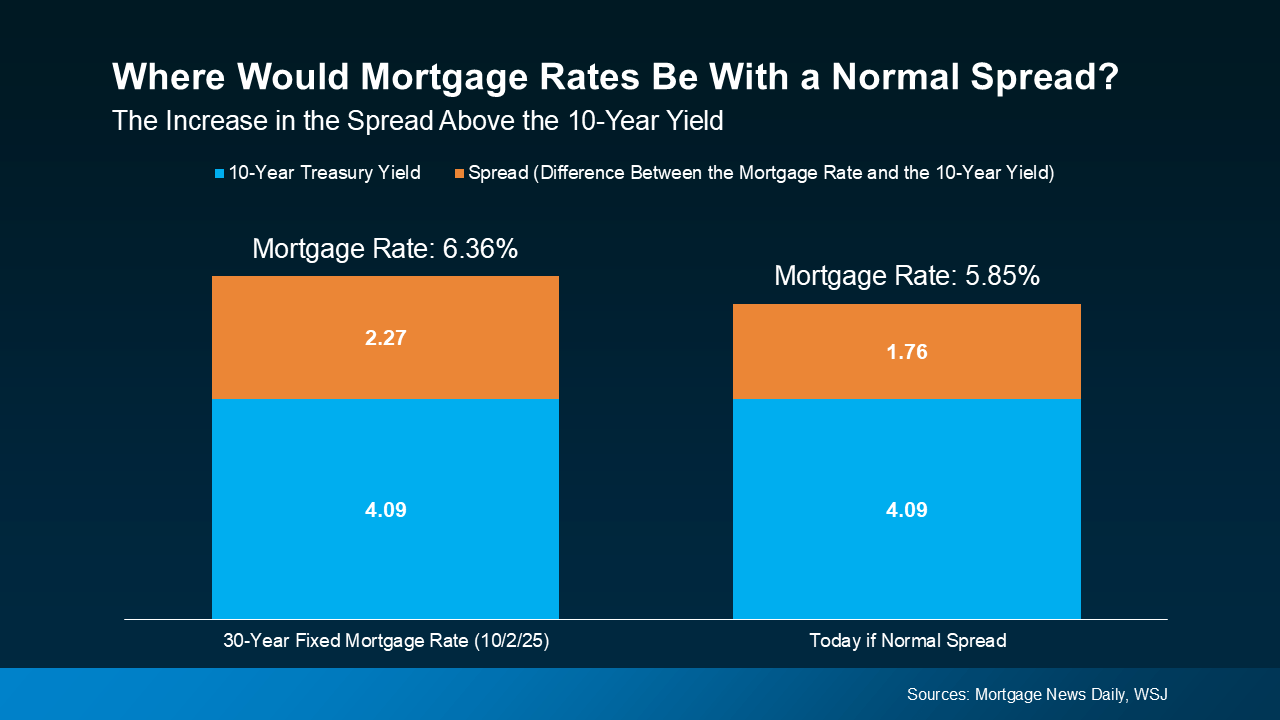

For over 50 years, the 30-year fixed mortgage rate has closely followed the movement of the 10-year treasury yield, which is a widely watched benchmark for long-term interest rates (see graph below):

When the treasury yield climbs, mortgage rates tend to follow. And when the yield falls, mortgage rates typically come down.

When the treasury yield climbs, mortgage rates tend to follow. And when the yield falls, mortgage rates typically come down.

It’s been a predictable pattern for over 50 years. So predictable, that there’s a number experts consider normal for the gap between the two. It’s known as the spread, and it usually averages about 1.76 percentage points, or what you sometimes hear as 176 basis points.

Over the past couple of years, though, that spread has been much wider than normal. Why? Think of the spread as a measure of fear in the market. When there’s lingering uncertainty in the economy, the gap widens beyond its usual norm. That’s one of the reasons why mortgage rates have been unusually high over the past few years.

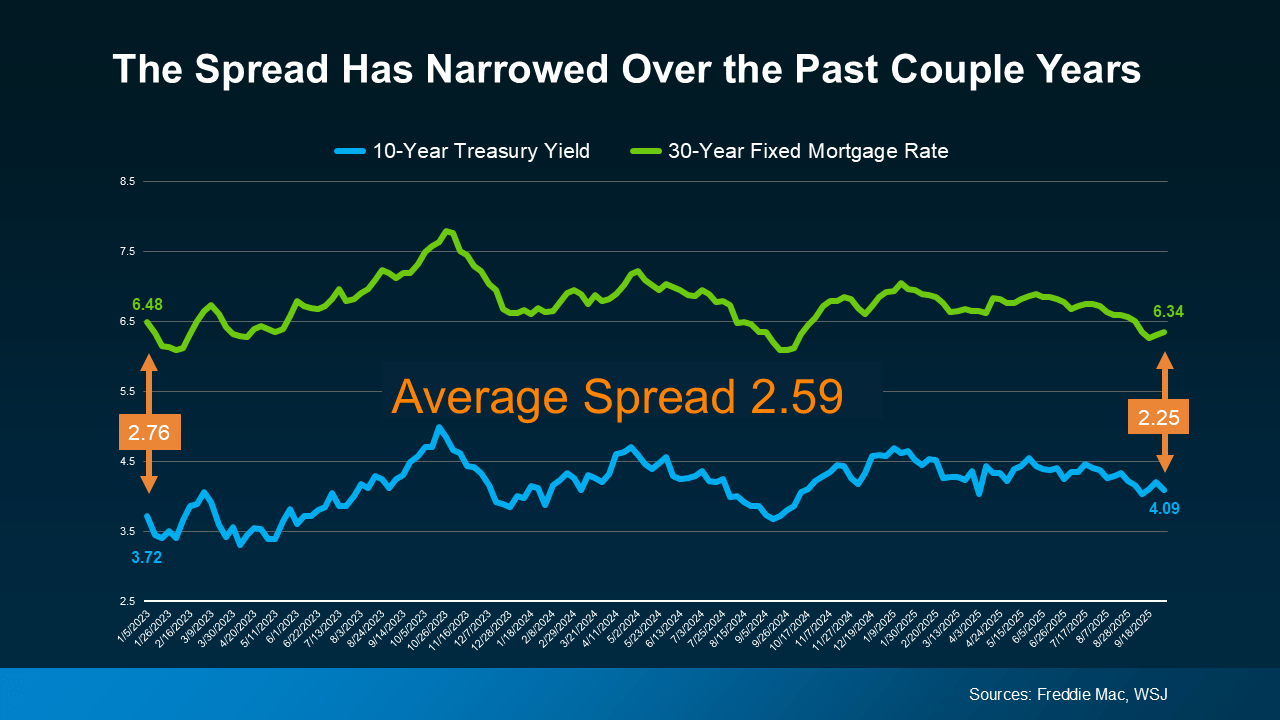

But here’s a sign for optimism. Even though there’s still some lingering uncertainty related to the economy, that spread is starting to shrink as the path forward is becoming clearer (see graph below):

And that opens the door for mortgage rates to come down even more. As a recent article from Redfin explains:

And that opens the door for mortgage rates to come down even more. As a recent article from Redfin explains:

“A lower mortgage spread equals lower mortgage rates. If the spread continues to decline, mortgage rates could fall more than they already have.”

It’s not just the spread, though. The 10-year treasury yield itself is also forecast to come down in the months ahead. So, when you combine a lower yield with a narrowing spread, you have two key forces potentially pushing mortgage rates down going into next year.

This long-term relationship is a big reason why you see experts currently projecting mortgage rates will ease, with a fringe possibility they’ll hit the upper 5s toward the end of next year.

Here’s how it works. Take the 10-year treasury yield, which is sitting at about 4.09% at the time this article is being written, and then add the average spread of 1.76%. From there, you’d expect mortgage rates to be around 5.85% (see graph below):

But remember, all of that can change as the economy shifts. And know for certain that there will be ups and downs along the way.

But remember, all of that can change as the economy shifts. And know for certain that there will be ups and downs along the way.

How these dynamics play out will depend on where the economy, the job market, inflation, and more go from here. But the 2026 outlook is currently expected to be a gradual mortgage rate decline. And as of now, things are starting to move in the right direction.

Keeping up with all of these shifts can feel overwhelming. That’s why having an experienced agent or lender on your side matters. They’ll do the heavy lifting for you.

If you want real-time updates on mortgage rates, let’s connect so you have someone to keep you in the loop and help you plan your next move.

If you’ve been watching from the sidelines, now’s the time to lean in. It’s officially the best time to buy this year. According to Realtor.com, this October will have the most buyer-friendly conditions of any month in 2025:

“By mid-October, buyers across much of the country may finally find the combination of inventory, pricing, and negotiating power they’ve been waiting for—a rare opportunity in a market that has been tight for most of the past decade.”

So, if you’re ready and able to buy right now, shooting for this month means you should see:

Just remember, every market is different. For most of the top 50 largest metros, that sweet spot falls in October. But the peak time to buy may be slightly earlier or later, depending on where you live. As Realtor.com explains:

“While Oct. 12–18 is the national “Best Week,” timing can shift depending on the local markets. . .”

And Realtor.com isn’t the only one saying you’ve got an opportunity if you move now. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“Homebuyers are in the best position in more than five years to find the right home and negotiate for a better price. Current inventory is at its highest since May 2020, during the COVID lockdown.”

Daryl Fairweather, Chief Economist at Redfin, puts it like this:

“Nationally, now is a good time to buy, if you can afford it . . . with falling mortgage rates and significantly more inventory, buyers have an upper hand in negotiations.”

And NerdWallet says:

“This fall just might be the best window for home buyers in the past five years.”

To make sure you’re ready to jump in whenever your market’s best time to buy arrives, talk to a local agent now. They’ll be able to give you more information on your market’s peak time, why it’s good for you, and the steps you’ll need to take to get ready.

If you’re serious about buying, getting prepped for this October window is a smart play.

Want help lining up your strategy? Let’s have a quick conversation so you’ve got the information you need to be ready for this prime buying time.

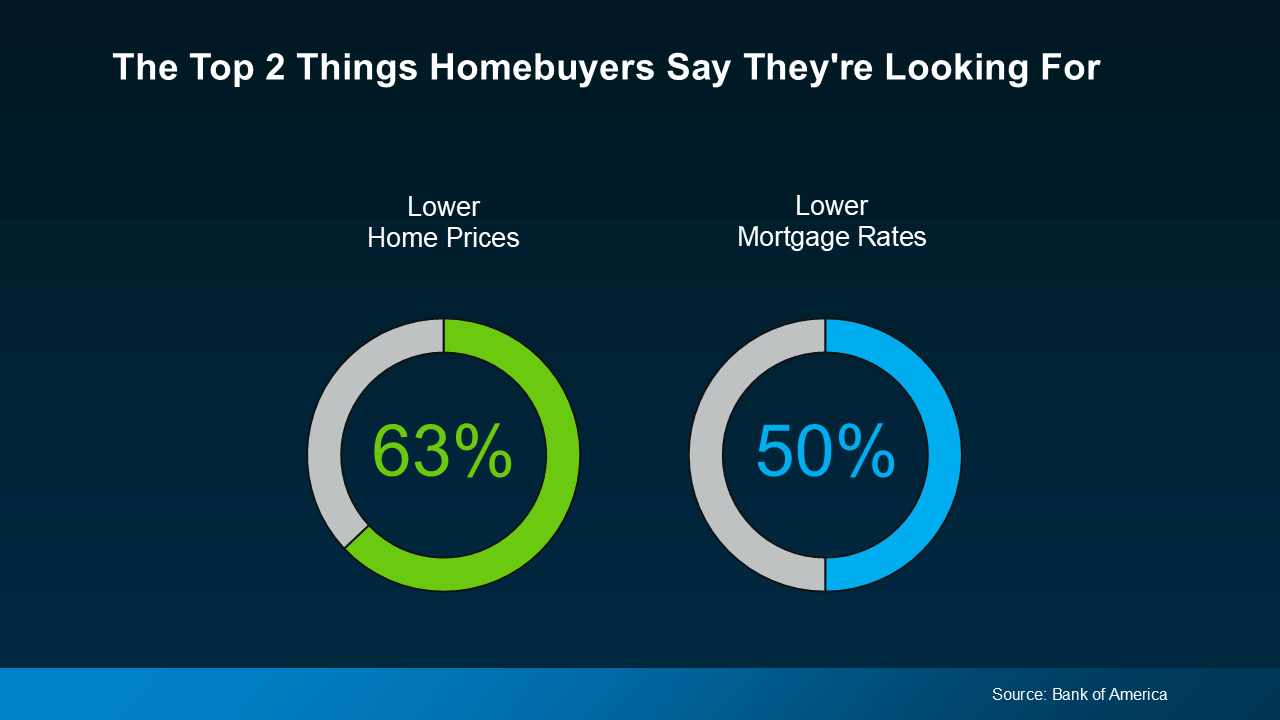

A recent survey from Bank of America asked would-be homebuyers what would help them feel better about making a move, and it’s no surprise the answers have a clear theme. They want affordability to improve, specifically prices and rates (see below):

Here’s the good news. While the broader economy may still feel uncertain, there are signs the housing market is showing some changes in both of those areas. Let’s break it down so you know what you’re working with.

Here’s the good news. While the broader economy may still feel uncertain, there are signs the housing market is showing some changes in both of those areas. Let’s break it down so you know what you’re working with.

Over the past few years, home prices climbed fast, sometimes so fast it left many buyers feeling shut out. But today, that pace has slowed down. For comparison, from 2020 to 2021, prices rose by 20% in a 12-month period. Now? Nationally, experts are projecting single-digit increases this year – a much more normal pace.

That’s a sharp contrast to the rapid growth we saw just a few short years ago. Just remember, price trends are going to vary by area. In some markets, prices will continue to rise while others will experience slight declines.

Prices aren’t crashing, but they are moderating. For buyers, the slowdown makes buying a home a bit less intimidating. It’s easier to plan your budget when home values are moving at a much slower pace.

At the same time, rates have come down from their recent highs. And that’s taken some pressure off would-be homebuyers. As Lisa Sturtevant, Chief Economist at Bright MLS, says:

“Slower price growth coupled with a slight drop in mortgage rates will improve affordability and create a window for some buyers to get into the market.”

Even a small drop in mortgage rates can mean a big difference in what you pay each month in your future mortgage payment. Just remember, while rates have come down a bit lately, they’re going to experience some volatility. So don’t get too caught up in the ups and downs.

The overall trend in the year ahead is that rates are expected to stay in the low to mid-6s – which is a lot better than where they were just a few short months ago. They may even drop further, depending on where the economy goes from here.

Confidence in the economy may be low, but the housing market is showing signs of adjustment. Prices are moderating, and rates have come down from their highs.

For you, that may not solve affordability challenges altogether, but it does mean conditions look a little different than they did earlier this year. And those shifts could help you re-engage as we move into next year.

Both of the top concerns for buyers are seeing some movement. Prices are moderating. Rates are easing. And both trends could stick around going into 2026.

If you’re considering a move, let’s connect walk you through what’s happening in our area – and what it means for your plans.

There are plenty of headlines these days calling for a housing market crash. But the truth is, they’re not telling the full story. Here’s what’s actually happening, and what the experts project for home prices over the next 5 years. And spoiler alert – it’s not a crash.

Yes, in some local markets, prices are flattening or even dipping slightly this year as more homes hit the market. That’s normal with rising inventory. But the bigger picture is what really matters, and it’s far less dramatic than what the doom-and-gloom headlines suggest. Here’s why.

Over 100 leading housing market experts were surveyed in the latest Home Price Expectations Survey (HPES) from Fannie Mae. Their collective forecast shows prices are projected to keep rising over the next 5 years, just at a slower, healthier pace than what we’ve seen more recently. And that kind of steady, sustainable growth should be one factor to help ease your fears about the years ahead (see graph below):

And if you take a look at how the various experts responded within the survey, they fall into three main categories: those that were most optimistic about the forecast, most pessimistic, and the overall average outlook.

And if you take a look at how the various experts responded within the survey, they fall into three main categories: those that were most optimistic about the forecast, most pessimistic, and the overall average outlook.

Here’s what the breakdown shows:

Do they all agree on the same number? Of course not. But here’s the key takeaway: not one expert group is calling for a major national decline or a crash. Instead, they expect home prices to rise at a steady, more sustainable pace.

That’s much healthier for the market – and for you. Yes, some areas may see prices hold relatively flat or dip a bit in the short term, especially where inventory is on the rise. Others may appreciate faster than the national average because there are still fewer homes for sale than there are buyers trying to purchase them. But overall, more moderate price growth is cooling the rapid spikes we saw during the frenzy of the past few years.

And remember, even the most conservative experts still project prices will rise over the course of the next 5 years. That’s also because foreclosures are low, lending standards are in check, and homeowners have near record equity to boost the stability of the market. Together, those factors help prevent a wave of forced sales, like the kind that could drag prices down. So, if you’re waiting for a significant crash before you buy, you might be waiting quite a long time.

If you’ve been on the fence about your plans, now’s the time to get clarity. The market isn’t heading for a crash. It’s on track for steady, slow, long-term growth overall, with some regional ups and downs along the way.

Want to know what that means for our neighborhood? Because national trends set the tone, but what really matters is what’s happening in your zip code. Let’s have a quick conversation so you can see exactly what our local data means for you.